how are 457 withdrawals taxed

As with any other type of 457 plan distribution required minimum distributions. Start Today With Our Free Easy to Use Online Chat.

Course Follow Ups Investing Personal Finance Club

If you were employed by a government agency you will fall under.

. Creating Your Retirement Income Plan. Open an IRA Explore Roth vs. In contrast the Roth version of the 457b allows you to put in money after-tax.

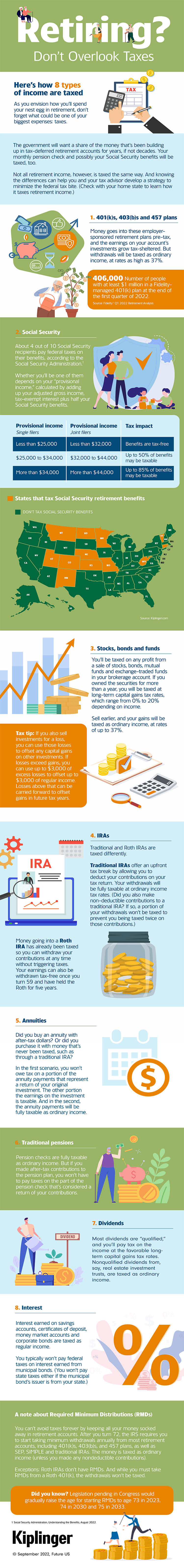

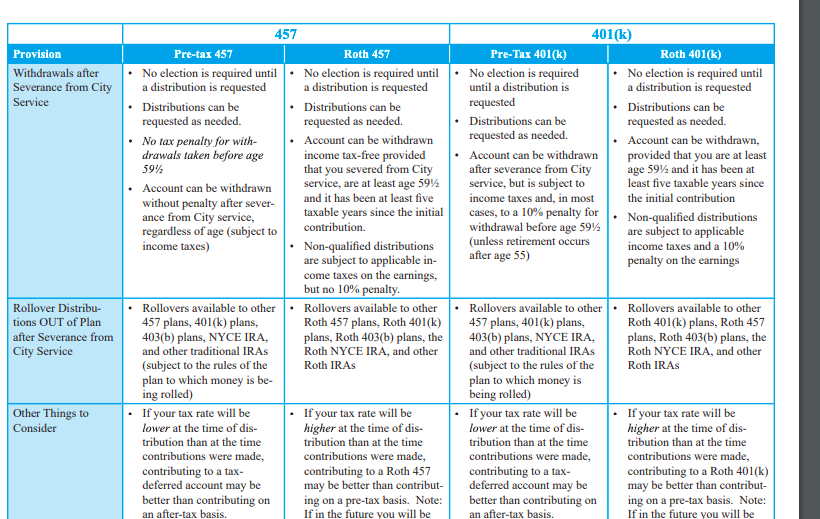

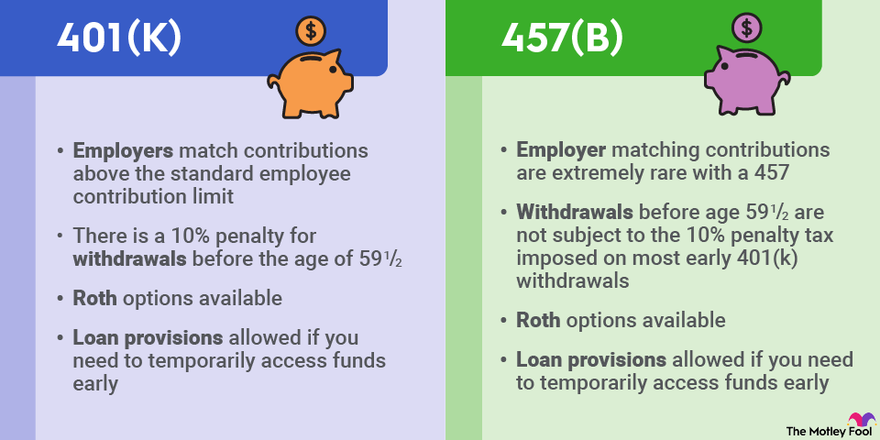

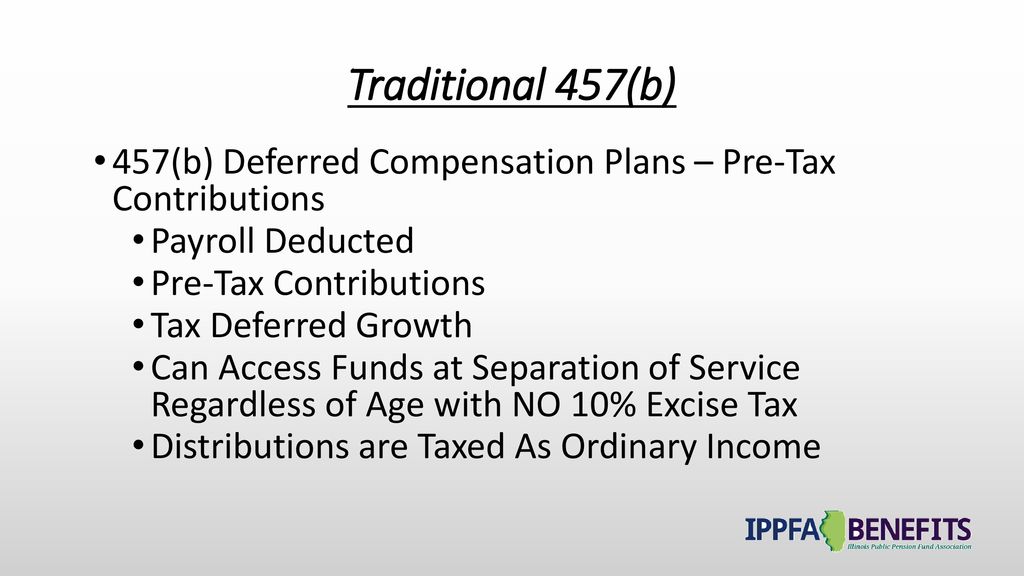

Traditional or Rollover Your 401k Today. 457 plans are taxed as income similar to a 401 k or 403. Contributions accumulate on a tax-deferred basis until distributed or for 457f plans when the employee is fully vested.

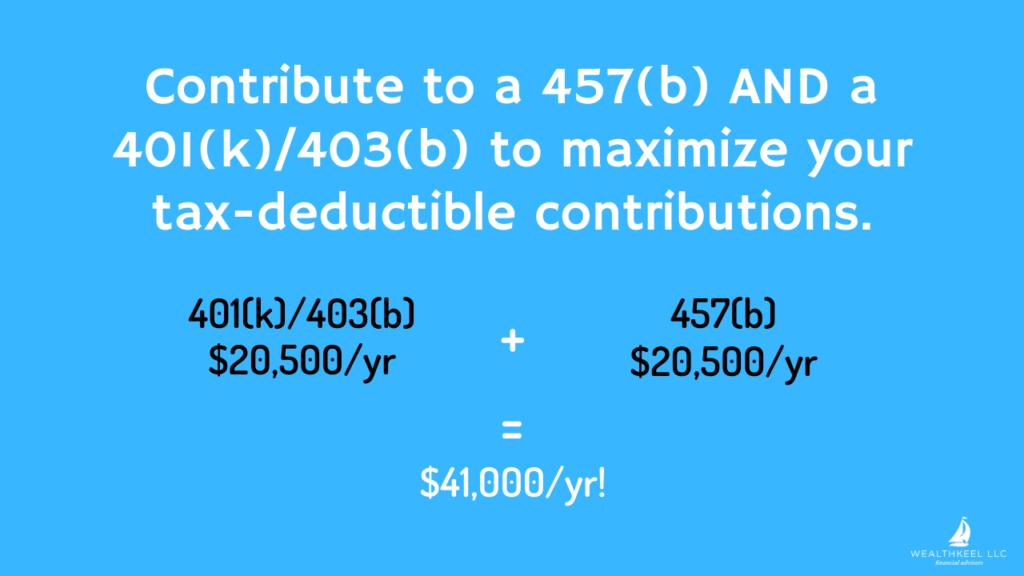

Like most retirement accounts the IRS imposes limits on how much can be contributed annually. Contributions to a 457 b plan are tax-deferred. Ad If you have a 500000 portfolio download your free copy of this guide now.

How is 457b taxed. 457 plans are non-qualified deferred-compensation plans offered to employees. However wit See more.

There is actually nothing basic about retirement withdrawals. Ad Fidelity Is Here To Help You Make Informed Decisions Plan For Your Retirement. Ad Build Your Future With a Firm that has 85 Years of Retirement Experience.

457 plans are taxed as income similar to a 401 k or 403. How is 457b taxed. 457 b Governmental plan.

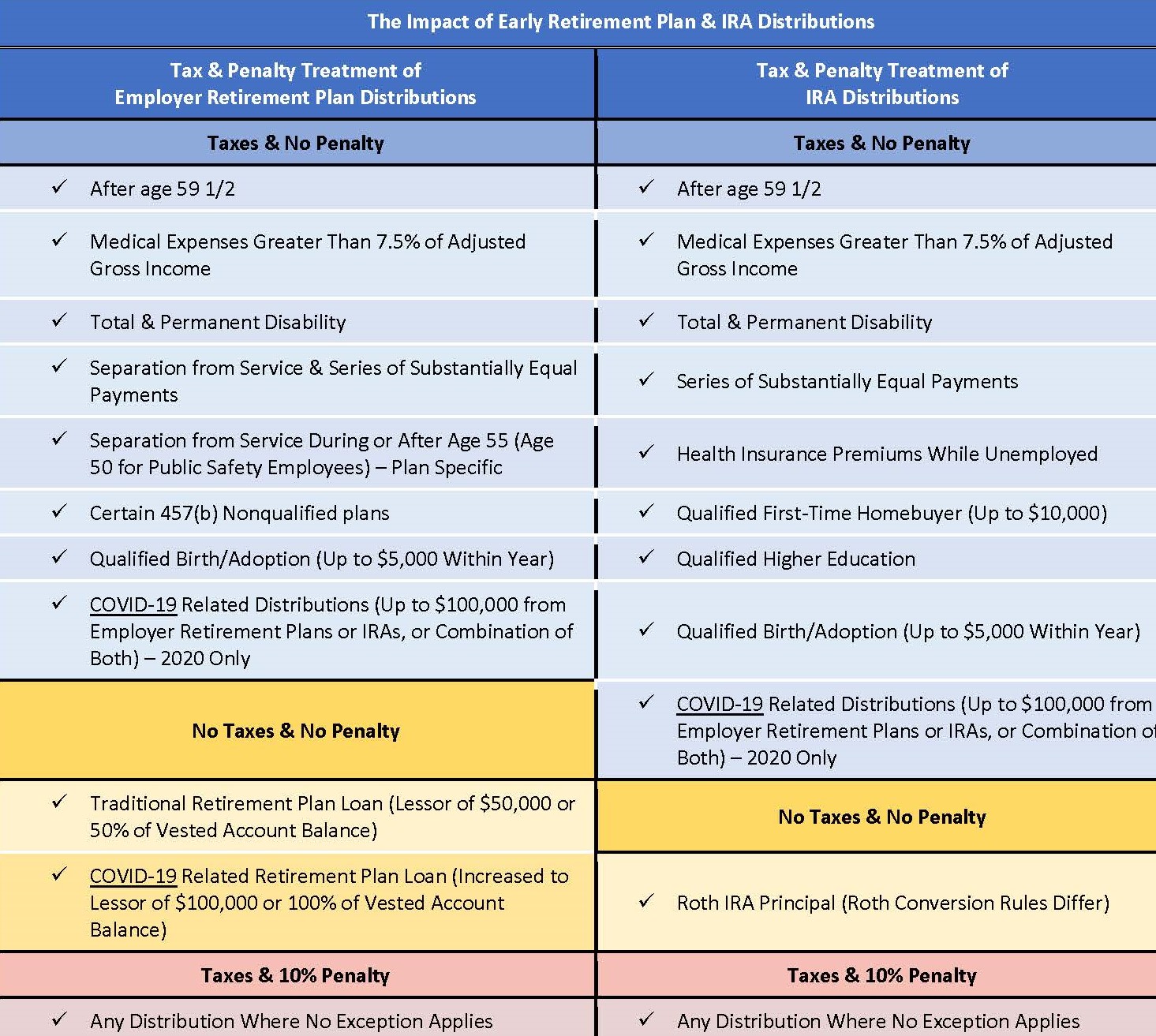

3405 do not apply to distributions from a tax-exempt employers 457b plan. How much tax do you pay on a 457 b withdrawal US federal tax law requires. Here is a list of.

Ad Take Charge Of Your Retirement Savings Today With These Quick And Personalized Tips. Withdrawals from 457 retirement plans are taxed as ordinary income. Contributions to your 457 b are deducted from your paycheck and may be.

Rollovers to other eligible retirement plans 401 k 403 b. Prepare For Your Future Today. Earnings on the retirement money are tax.

Withdrawing 1000 leaves you with 710 after taxes 457 Plan Withdrawal Calculator. Use this calculator to see what your net withdrawal would be after taxes are taken into. Ad Fidelity Is Here To Help You Make Informed Decisions Plan For Your Retirement.

Both governmental and non-governmental 457 b plans fall under the IRS. Ad Preparing for your ideal retirement starts with an effective retirement income plan. 457 plans are taxed as income similar to a 401 k or 403 b when.

The Most Tax Efficient Sequence Of Withdrawal Strategy Explained Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

Everything You Need To Know About A 457 Real World Made Easy

What Is A 457 B Plan Forbes Advisor

:max_bytes(150000):strip_icc()/ScreenShot2021-12-15at3.19.44PM-291c5fe0726d489fb990ff40378b295f.png)

Form 5329 Additional Taxes On Qualified Plans Definition

How Can I Get My 401 K Money Without Paying Taxes

457 Plan Meaning Retirement Plan Benefits Limits Vs 401k

457 Vs Roth Ira What You Should Know 2022

:max_bytes(150000):strip_icc()/taxes-in-retirement-how-much-will-you-pay-2388083v-6-5b4cba9fc9e77c0037315bd8-8ed4f6b983744e1ba2e910636aa65873.png)

Estimating Taxes In Retirement

457 B Deferred Compensation Plan Basics Ppt Download

How To Withdraw From Ira Accounts At 60 Years Old Sapling

Tax Deferred Vs Tax Free Investment Accounts David Waldrop Cfp

:max_bytes(150000):strip_icc()/required-minimum-distributions-2388780-468edc9cab63492cb046bc28d72fd5c1.jpg)

All About Required Minimum Distribution Rules Rmds

Sec 457 F Plans Get Helpful Guidance Journal Of Accountancy

:max_bytes(150000):strip_icc()/AP_401146136212-600579d89b014f62b098ed5ab375a3fc.jpg)

Are 457 Plan Withdrawals Taxable

457 B Vs 401 K Plans What S The Difference Smartasset

What Is A 457 B Plan How Does It Work Wealthkeel

Accessing Retirement Funds Early During Covid 19 Triage Cancer Finances Work Insurance